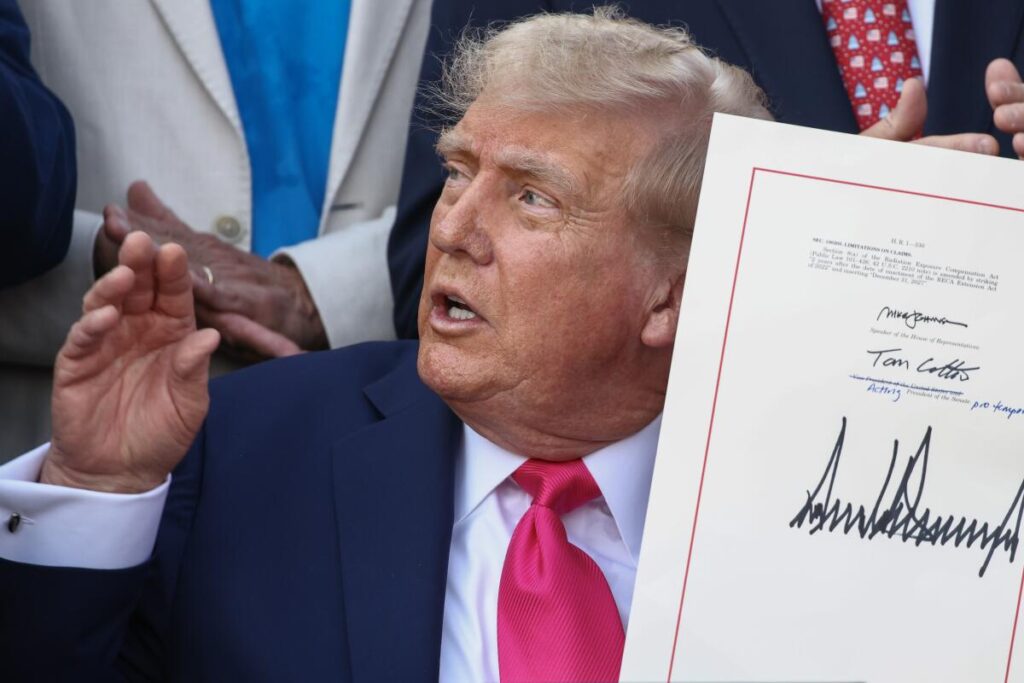

On July 4th, 2025, President Trump signed into law the so-called ‘One Big Beautiful Bill’ that will have significant impacts on US Residential Solar. If you’re interested in solar for your home, you need to act fast to take advantage of the 30% Residential Solar Tax Credit before the end of the year and own your own power production. Here’s what you need to know:

- The consumer tax credit (25D) ends at the end of 2025. Homeowner-owned solar systems need to be installed by Dec. 31, 2025 to claim this 30% tax credit before it’s gone.

- The business tax credit (48E) ends at the end of 2027, but companies will have until 1 year to “commence construction,” which then allows those projects up to 4 years to be completed and claim the full tax credit.

- Energy Storage tax credits remain for 48E, which will allow for retrofits or battery-only systems via a lease arrangement on the battery.

- The “excise tax” proposed in the updated Senate text is out. This provision appeared in the Senate draft proposed on June 30 and posed a serious financial risk to future solar and wind projects. However, it was removed before the final Senate vote, and is no longer in the bill.

Here at SolQ, our installation schedule is filling up quickly–if you want to make sure you’re able to own your own power production and take advantage of the 30% tax credit before it goes away at the end of the year, please don’t wait to reach out to us so that we’re able to reserve an installation spot for you before our 2025 capacity is completely filled.